Payroll errors are an unfortunate but common occurrence in the workplace. From miscalculations to missing deductions, these errors can have significant consequences for employees. One crucial document affected by payroll errors is the paycheck stub. In this article, we will delve into what payroll errors entail, how they impact employees, and most importantly, what steps you can take if you find discrepancies in your paycheck stub.

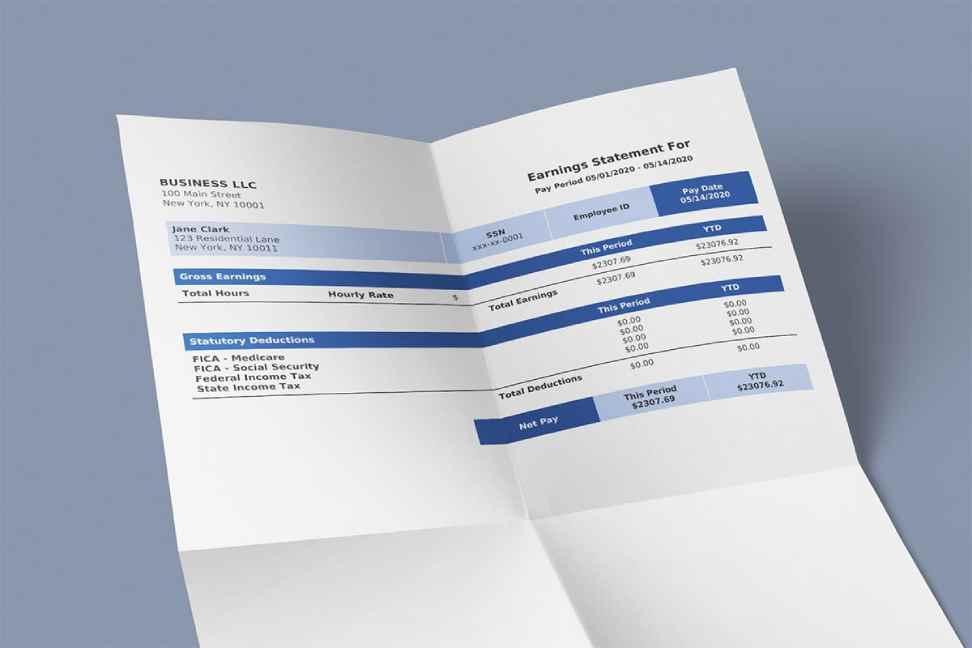

Understanding Paycheck Stubs:

Before delving into the actions to take when encountering a payroll error, it’s essential to understand what a paycheck stub is. A paycheck stub, also known as a pay stub, is a document provided by employers to their employees, detailing the wages earned for a specific pay period. It typically includes information such as gross earnings, deductions for taxes and benefits, and net pay.

Common Types of Payroll Errors:

Calculation Errors:

One of the most common payroll errors is calculation mistakes. These errors can occur due to human error or glitches in payroll software. Calculation errors may result in incorrect wages being paid to employees, leading to discrepancies in their paycheck stubs.

Deduction Errors:

Deduction errors involve mistakes in deducting taxes, benefits, or other withholdings from employees’ paystub generator free. This can lead to over or under-deductions, affecting the net pay received by employees.

Omission Errors:

Omission errors occur when certain earnings or deductions are not included in the paycheck stub. This could be due to oversight or negligence on the part of the payroll department, resulting in inaccurate documentation of employees’ earnings and withholdings.

Impact of Payroll Errors:

Payroll errors can have far-reaching consequences for employees. Beyond the inconvenience of receiving incorrect pay, these errors can lead to financial strain and even legal issues.

Financial Consequences:

An incorrect real pay stub can disrupt an employee’s budget and financial planning. Over or underpayment can cause financial hardship, affecting their ability to meet expenses and obligations.

Legal Implications:

In some cases, payroll errors may violate labor laws or employment contracts, exposing employers to legal liability. Employees have the right to accurate and timely payment for their work, and any deviations from this may result in legal action.

Steps to Take If Your Paycheck Stub is Incorrect:

Encountering a payroll error can be stressful, but there are steps you can take to address the issue promptly and effectively.

Review Your Paycheck Stub Carefully:

The first step is to carefully review your paycheck stub for any discrepancies. Check each line item against your records and ensure that all earnings and deductions are accurate.

Inform HR or Payroll Department:

If you identify an error in your paycheck stub, notify your company’s HR or payroll department immediately. Provide them with specific details of the error and any supporting documentation you may have.

Keep Documentation:

It’s essential to keep detailed records of any communication regarding the payroll error. This includes emails, written correspondence, and notes from phone conversations. Documentation will be crucial if further action is necessary.

Follow Up Regularly:

After reporting the error, follow up with the HR or payroll department regularly to ensure that the issue is being addressed. Be persistent in seeking resolution and escalate the matter if necessary.

Resolving Payroll Errors Amicably:

In many cases, payroll errors can be resolved amicably through communication and cooperation between employees and employers.

Negotiation with Employer:

Open dialogue with your employer or HR department can often lead to a swift resolution of the payroll error. Discuss the issue calmly and professionally, providing any necessary evidence to support your claim.

Seeking Legal Advice:

If attempts to resolve the payroll error internally are unsuccessful, consider seeking legal advice. An employment lawyer can assess your situation and provide guidance on your rights and options for recourse.

Importance of Keeping Records:

Maintaining accurate records of your earnings, deductions, and correspondence with the HR or payroll department is crucial. These records serve as evidence in case of disputes and can help expedite the resolution process.

Preventing Future Payroll Errors:

While encountering a payroll error can be frustrating, there are steps you can take to minimize the likelihood of recurrence.

Double-Checking Paycheck Stubs:

Take the time to review your paycheck stub carefully with each pay period. Verify that all earnings and deductions are correct and raise any concerns promptly.

Communicating Changes Promptly:

If there are any changes to your employment status or personal information, such as a change in tax withholding or benefits enrollment, communicate these changes to the HR or payroll department promptly.

Seeking Clarification:

If you are unsure about any aspect of your paycheck stub or notice something unusual, don’t hesitate to seek clarification from the HR or payroll department. It’s better to address any concerns proactively rather than waiting for a potential error to occur.

Conclusion:

Encountering a payroll error can be a stressful experience, but it’s essential to address the issue promptly and assertively. By understanding your rights, communicating effectively with your employer, and keeping detailed records, you can navigate the process of resolving payroll errors with confidence.

FAQs:

What should I do if I notice a discrepancy in my paycheck stub?

Immediately notify your company’s HR or payroll department and provide them with specific details of the error.

How long does it typically take to resolve a payroll error?

The resolution timeline can vary depending on the nature and complexity of the error. It’s essential to follow up regularly and escalate the matter if necessary.

Can I seek legal action for a payroll error?

If attempts to resolve the error internally are unsuccessful, you may consider seeking legal advice to explore your options for recourse.

How can I prevent future payroll errors?

Double-check your paycheck stubs regularly, communicate any changes promptly, and seek clarification on any discrepancies or concerns.

What should I do if my employer refuses to acknowledge or address the payroll error?

If your employer is unresponsive or unwilling to address the error, consider seeking assistance from an employment lawyer to protect your rights and interests.

Have A Look :-

- EPFO Has Invested Rs 1.88 Lakh Crore In ETFs In Five Years: Data

- Goldman Sachs Reveals Another Business Plan Under The CEO David Solomon

- Rolls-Royce Makes History By Making The World’s Most Expensive Car La Rose Noire Droptail Is Worth Rs 211 crore