Before I begin this article, I would like to caution you by saying that this is not professional financial advice. It would be better for you to consult with a Financial Advisor about your present circumstances at best. In this article, I am going to do a general discussion on why is Amazon’s stock down.

Keep reading till the end of the article to find out more information regarding “why is Amazon stock down”!

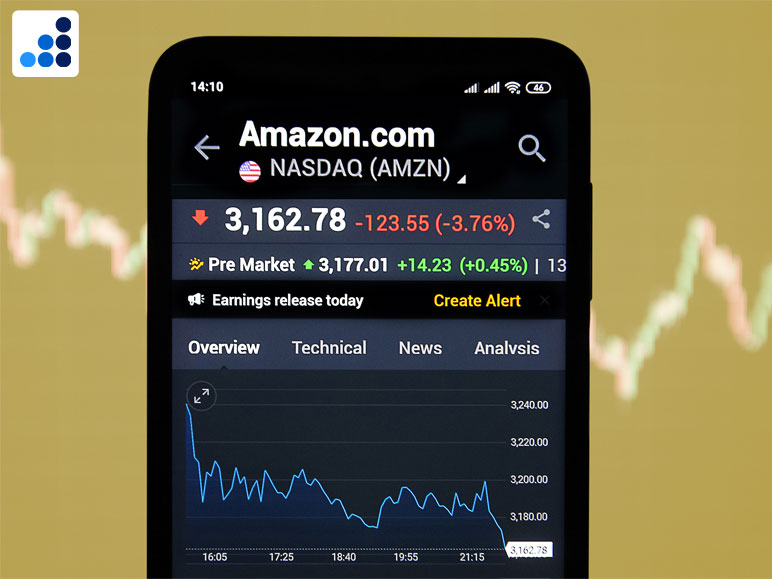

Reasons For Massive Drop In Amazon’s Stocks

If you are wondering why Amazon stock is down? Here is a list of some of the possible reasons for Amazon Stocks facing a great low:

1. Competition

There are a lot of concerns regarding the increasing amount of competition when it comes to online shopping – and Amazon, which is the biggest e-marketplace, isn’t any exception to that.

2. FTC Lawsuit

The FTC which stands for Federal Trade Commission had also filed a lawsuit of antitrust and accused Amazon of operating a monopoly illegally online. This is yet another reason why is Amazon stock going down.

3. High-Interest Rates

This is one such factor that can primarily act as a brake on the economy. In terms of this, Amazon remains exposed to it through the medium of its e-commerce and cloud computing.

4. Jeff Bezos Selling Stock

There have also been reports regarding the founder and CEO of Amazon, Jeff Bezos, selling massive amounts of Amazon stocks.

5. Rising Bond Yields

This also has hurt the growth stocks of Amazon. These have a very big portion of earnings in the future.

Risks Associated With Investing In Amazon Stocks

There are a lot of risks that are involved in investing in Amazon stocks. Here we will be discussing a few possibilities which might make investing in their stocks, more loss-inducing than beneficial for you:

Highly Speculative Form Of Valuation

The Amazon shares valuation poses a great form of investment risk. Speculation is very common among unprofitable companies with an additional medium term. This fact increases the risk of unmet expectations all the more. As a result of this type of speculation, high share prices are volatile.

The shareholders of the Amazon marketplace are going to be subject to even more market risk and a widespread downturn is going to disproportionately have an impact on the high beta stocks like Amazon.

Why is Amazon stock down today? The speculative valuation is also partly at fault for it.

Tip: At the time of writing, the current market cap of Amazon stands at 1.52Tn.

Massive Competition

Competition is considered to be the most crucial operational risk that is faced by the marketplace of Amazon. The retail industry in general is very competitive and also includes various formidable competitors like Target Corporation, Wal-Mart Stores Inc., and Costco Wholesale Corporation.

The rapid ascent of Amazon has further prompted the other retailers to forge their strategies which are specifically crafted for combatting giant online-influence. A competitive sort of pricing not only leads to Amazon getting a market advantage but also leads to drowning margins across the board for the different participants in the market.

Tip: If you missed out on my answer on “why Amazon stock is down today” which I discussed towards the beginning of the article, you can go back to give it a read.

Slow Down Of Growth In Revenue

Amazon has always delivered a very strong performance when it comes to growth, especially over the last ten years. But in the more recent times, growth has slowed down by a lot!

If the revenue growth keeps going down in this way then, the investments are also going to prove to be fruitless. If both the earnings and revenue do not exhibit a sustained amount of high rates (in the future), then the valuation of Amazon’s stocks stands to be unjustified.

Important Factors To Consider When Buying/Selling Stocks

Here is a list of some factors which you should keep in mind when purchasing/selling any kind of stock:

1. Know About The Upcoming Events

Any sort of upcoming event regarding the company can be a reason for both selling and purchasing stock. The same event can also lead to various triggers in the stock’s price. Analyzing and knowing the event properly is also going to aid in determining the trend of the stock going forward.

Hence, the sale and buying of stock can also be initiated based on all of such events.

2. Select The Industry/Company Which You Have An Idea About

Prior to getting started with investing in the stock market, you need to select the industry that you like the most. This is going to make you more interested and also will help you in deciding in a much more informed way.

When a person is aware of the company and industry, they know the exact hype to ignore.

3. Consider The Price And Valuation

Before investing in any kind of stock, it also becomes very important to consider both the valuation and price of the stock. If a company trades PE multiples of less than twenty then that is essentially considered to be undervalued and not a good buy.

Meanwhile, a company that trades PE multiples of more than twenty, they are considered to be overvalued – and hence a good sell.

4. Make An Evaluation Of Financial Reports

It is very important to understand and go through the financial reports of a company first, before investing in them. Make sure that you are studying the yearly reports and also comparing the financial stats of them.

The company that you invest in should be making consistent growth gradually over time. You also need to look for any cash payouts for the stock investors in the form of dividends.

5. Technical Indicators

In more recent times, the technical indicators have been gaining a lot more popularity. There are a lot of technical indicators that come in the form of charts and work in predicting the future moment of stocks based on stock movements in more recent times.

The information that is provided by the technical indicators is very valuable when determining whether to invest in a company’s stocks or not.

To Wrap It Up!

Investing in any type of stock has its fair share of associated risks. You need to be careful when determining a company to invest in. Also, make sure to create a diversified portfolio when investing in stocks. Just investing in Amazon won’t guarantee you success in the field.

Thank you for reading up till here. I hope you found the information about “Why is Amazon stock down” useful!

Additional:

- What Is Destiny Credit Card?

- LL Bean Credit Card Review

- EPFO Has Invested Rs 1.88 Lakh Crore In ETFs In Five Years: Data